| PREVIOUS | HOME | NEXT |

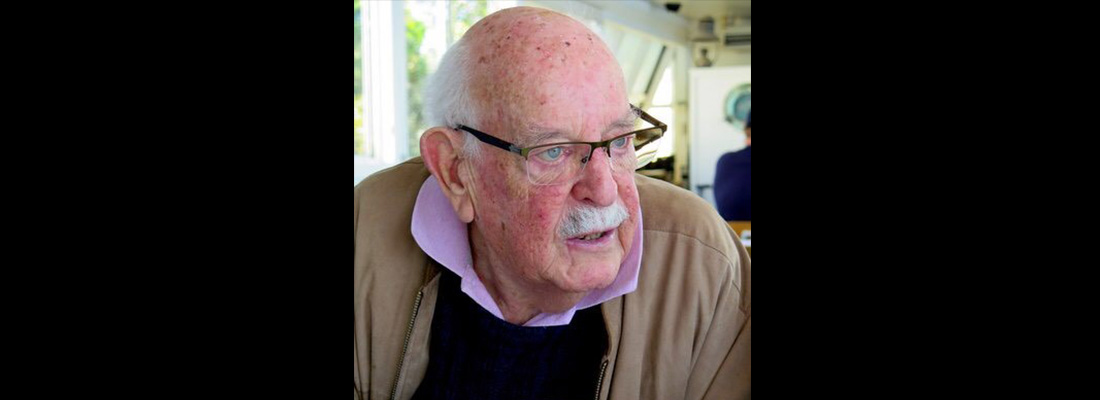

The late Frank Hoffmann Industry great mourned Compiled by Resolve editor Kate Tilley* The insurance industry lost one of its greats when Frank Leopold Gaston Hoffmann died on 4 February 2019. Frank, 84, was a founder of AILA, the father of underwriting agencies in Australia, having established Jardine Underwriting Agencies, which was likely the first registered under the then Agents & Brokers Act 1984 (repealed 2001), and involved in the formation of NIBA. He was president of the Corporation of Insurance Brokers of Australia (CIBA), one of the bodies that merged to form NIBA in 1982. At his 12 February wake, Frank's daughter Tina Mackinnon said Frank was born in Milano, Italy, on 28 November 1934. His mother, Alma, was an Italian Catholic and his father, Frederic, an Austrian Jew. By 1938, Europe's ugly political situation prompted the family to migrate. They applied for immigration papers to the US, the Philippines and Australia; the Australian papers arrived first. Early in 1939, the family sailed for Sydney. The first Australian port of call was Fremantle, where Frank, aged 4, ran down the gangplank straight into a telegraph pole and knocked himself out. He spent three days in the ship's infirmary but Tina said he always maintained the incident cured his stutter and "changed him from a quiet, introverted child to the opinionated character we all knew and loved and who was never shy to share his opinion". The family initially lived in Mosman, Sydney, before moving to Northbridge. Frank was offered a place at Fort Street Opportunity School, where he developed his love of reading, especially drama and poetry, and began his involvement in debating and public speaking. Aged 12, he auditioned for a place in a kids' radio panel show, Juvenile Jury. He remained with the show for almost three years and became "quite a celebrity". At North Sydney Boys High School, he excelled in debating, was first violinist in the school orchestra, a senior librarian, and played a mean game of hockey. In his final year of high school he successfully auditioned for the juvenile lead in a 25-minute "careers film" for the Bank of NSW. For six weeks, Frank was surrounded by well-known professional actors. He loved every minute of it and was initiated into cards, something he continued to enjoy for the rest of his life. Tina said: "It is quite extraordinary this young lederhosen-wearing, stuttering immigrant, who fled war-torn Europe with his family 80 years ago, went on to embrace every opportunity and overcome every hurdle, and turned into an articulate businessman, and loving husband, father and grandfather. Frank literally made an impact from the moment he hit Australian soil (or in his case a telegraph pole) and continued influencing and impacting on a huge range of people throughout his life." Frank took over his father's insurance broking business in 1952 and sold it in 1974 but continued his long involvement in the industry as a mentor, educator, expert witness and consultant. Long-time friend, insurance lawyer Michael Gill said: "The Franco stories we all cherish will be repeated and shared by those who knew him and those for whom he will be an important part of our history." Michael and Frank met almost 50 years ago in the office of insurance lawyer John Mant, snr, when Michael was in his second year of articles. He started learning from both about insurance disputes and policy advice. Michael said many colleagues were in awe of Frank for his knowledge; his serious intelligence; his analytical skills, deep, quick and invariably correct; his unwavering honesty and integrity; his clear communication; economy of words (sometimes delivered with a little barb); his generosity; and his unwavering insistence on doing the right thing. In the insurance context, that often led to an instant and passionate exposition on the real meaning of utmost good faith. Frank saw its broad role as applying to both insurer and insured while most lawyers, judges and insurers thought it was no more than a sledge hammer for underwriters to crush insureds who failed to fully disclose. Frank was invited to be a consultant to the Australian Law Reform Commission on its insurance law reference. Michael said Report 20 was "a litany of examples of what at the time was crook law. Crook for the punter that is. And inexcusably crook, as Frank saw it. "Overall, he remained satisfied, even proud of their work and the legislation. But not all of it. The judicial intrusion of scope-of-cover issues into section 54 didn't please him nor did the limited application of utmost good faith." Frank worked with former High Court judge Michael Kirby on the Insurance Contracts Act, who described him as: "An outstanding human being, expert, and true servant of honour in business. He truly believed the market was compatible with decency and fidelity in business dealings. In late 1982, Frank, Michael, Syd Mcdonald, Robert Owen and John Hastings began mulling over a new association for those with an interest in insurance law. Michael recalled he and John had been at an AIDA Congress in London earlier in the year and the then AIDA president had asked them to "give it a go". Within a year AILA was born. There were great planning meetings, good food and wines, robust discussion, and it was well before smoking bans. "There was much pacing and puffing by Frank in his stockinged feet before we agreed on the two reasons which continue to sit at the core of AILA," Michael recalled.

Frank and Robert drove AILA's clarity of purpose and Michael came to understand Frank's passion for and commitment to education and professionalism. He recalls an early event, "Ask the oracle". Frank was one of the oracles and "the queue at his table resembled the launch of the latest Apple iPhone". Frank helped AILA expand interstate and overseas. He became president and was awarded life membership. He was a committee member for the 1994 World Insurance Congress in Sydney, attended by representatives from more than 50 countries. Frank was a smoker, but even at his peak of 130 a day, he gave it up for lent. Michael recalls a lunch when a waiter provided a soft pack from the cigarette machine. Frank removed one and started waving it around, held between his fingers to emphasise his point. The waiter offered an ignited lighter but Frank stopped mid stream and said: "Son, it's lent. I don't smoke in lent." Nevertheless, during the lunch, he destroyed the full pack, gesticulating and stubbing the unlit cigarettes in the ash tray. On another occasion, he was clearly growing impatient with what he thought was an overdone dissertation on the benefits of being vegetarian. Interrupting, he said: Michael said the industry benefitted from Frank's "unique knowledge and experience as a consultant and, most importantly, expert witness. He did not fear the witness box nor any personal consequence for telling the truth, sometimes to the disadvantage of this industry or part of it". Frank is survived by his wife, Jennie. He was the loving father and father-in-law of Anthony and Samantha, Tina and Chris, and David and Kay; brother of Margherita; and adored Pa of Alexander, Gemma, Krystal, Bella and Andrew. His achievements included:

* Compiled from tributes to Frank from long-time friend, insurance lawyer Michael Gill, Frank's daughter Tina Mackinnon, and others. |

Resolve is the official publication of the Australian Insurance Law Association and

the New Zealand Insurance Law Association.