| PREVIOUS | HOME | NEXT |

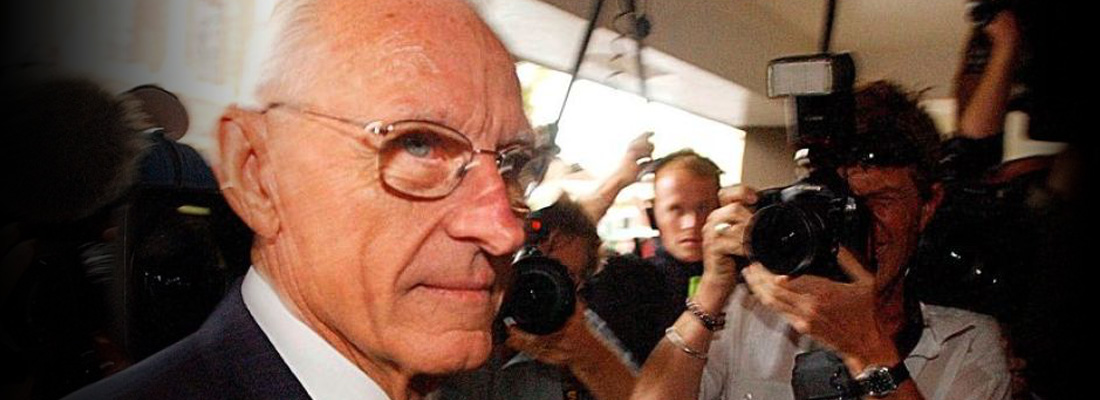

HIH 'misled shareholders' By John Reynolds and Kate Tilley, KT Journalism Some investors who bought shares in the failed insurer HIH in the 18 months before it collapsed are entitled to damages, the NSW Supreme Court has ruled. The court judgement is the latest in a long-running saga of litigation that has followed the demise of HIH Insurance Ltd and its associated companies. They said that led to HIH shares being sold at inflated prices before being declared valueless when the insurer collapsed on 15 March 2001, leaving total debts of about $5.3 billion. The shareholders lodged proofs of debt for their claimed losses in the liquidation of HIH and the schemes of arrangement for its subsidiaries, FAI General Insurance Co Ltd and HIH Casualty & General Insurance Ltd (C&G), but the liquidators and scheme administrators did not admit them. NSW Supreme Court Justice Paul Brereton said the three principles for him to decide were: Justice Brereton said HIH had entered into two arrangements with Hannover Re that, in the FAI and C&G financial statements and consequently in HIH’s consolidated financial statements, were accounted for as conventional reinsurance contracts. However, they were actually so-called “financial” reinsurance contracts. By accounting for them incorrectly the insurers could report “significantly greater operating profit” for FY1999 — $92.4 million for the consolidated entity. HIH’s FY2000 final results, released on 17 October 2000, reported a consolidated operating profit of $61.9 million but, if the Hannover Re contracts had been treated correctly, HIH would have reported a loss. Justice Brereton said accessorial liability required actual knowledge of the essential facts that made what was done by the principal contravener a contravention. “A director is not a party to the corporation’s contraventions merely by being a director; to be party to a contravention, the alleged accessory must be an intentional participant, the necessary intent being based on knowledge of the essential elements of the contravention. Thus, there are two elements of accessorial liability: knowledge and participation,” Justice Brereton said. He said participation was established, but accessorial liability also required “actual knowledge of the putative accessory and not such knowledge as might be postulated of a hypothetical person in his or her position, although actual knowledge may be established by inference from surrounding circumstances. The knowledge of a corporation can be established by the knowledge of a director, servant or agent by whom the relevant conduct was engaged in within that person’s actual or apparent authority”. The shareholders claimed former HIH CEO Ray Williams and HIH CFO Dominic Fodera, who were also directors of FAI and C&G, were aware the misleading results would be replicated in HIH’s consolidated results. Both men were later jailed for their roles in the collapse. On April 20, Justice Brereton rejected that argument. He said Mr Fodera, in particular, was a highly experience accountant and very familiar with the companies’ operating costs. “[The liquidators’] explanations are highly improbable,” Justice Brereton said. Justice Brereton said while there was no direct evidence Mr Fodera knew the Hannover Re arrangements were incorrectly treated and thus operating profits were overstated, “in the absence of admission, knowledge must usually be ascertained by inference”. The shareholders argued an appreciation of the true nature of the Hannover Re transactions, with associated letters of credit transferring the risk back to HIH, meant they were “implemented to create an appearance of profitability which the financial statements would not otherwise bear – in other words, to deceive”. Justice Brereton said Mr Williams’s annual review described the Hannover Re arrangements as “decisive action” by HIH to protect its business “from claims development uncertainties including potential underwriting exposures” while, in truth, the separate but related letter of credit meant the risk a managed fund would ultimately prove insufficient was retained by HIH. “Mr Fodera executed several of the critical documents which constituted the Hannover Re arrangements, including the letters of credit. That supports an inference he understood their effect.” Justice Brereton said the chain of causation was: “This can be tested by a counterfactual inquiry: what would have happened if each contravention had not occurred? The answer is the market price of HIH shares would have been lower and the [shareholders] would have paid less for the shares they acquired.” Justice Brereton said was “indirect causation”, despite the shareholders’ absence of direct reliance on the overstated accounts. There was no suggestion the shareholders knew the truth about, or were indifferent to, the contravening conduct, but proceeded to buy the shares nevertheless. Justice Brereton said, in principle, investors who bought shares from 25 August 1999 to 2 March 2000 were entitled to damages equivalent to 6.25% of the price they paid; those who bought shares from 3 March to 17 October 2000 to 9.5%; and those who bought shares after 17 October 2000 to 13%. In the matter of HIH Insurance Ltd (in liquidation) (ACN 008 636 575) and others; Smith, Baldock, De Bortoli Wines (Superannuation), Cuong Ly & ors v Anthony Gregory McGrath (in his capacity as liquidator) [2016] NSWSC 482, judgement 20/4/16 |

Resolve is the official publication of the Australian Insurance Law Association and

the New Zealand Insurance Law Association.