| PREVIOUS | HOME | NEXT |

Insurer cops judicial wrath by Resolve editor Kate Tilley

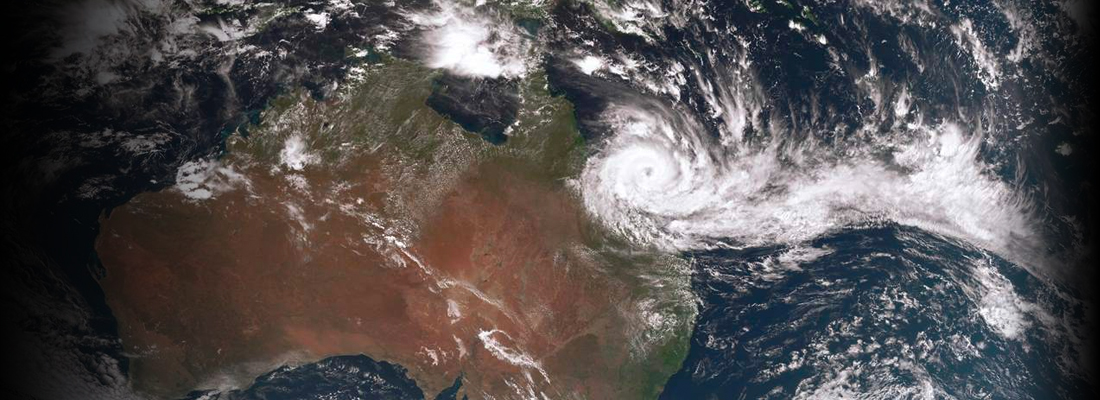

AILA patron and Federal Court Chief Justice James Allsop said Allianz’s attempt to resile from an earlier position to grant indemnity for some of the repairs was “not how an insurer should behave”. He ordered the claim be adjusted and determined in accordance with the policy terms. The Delor Vue complex at Cannonvale, near Airlie Beach, was built in 2008-2009 by developer Delorain Pty Ltd and builder Beachside Constructions (National) Pty Ltd. It has 11 multistorey residential apartment buildings with 62 lots. The policy placed with Allianz-owned underwriting agency Strata Community Insurance (SCI) was incepted on 23 March 2017. Tropical Cyclone Debbie hit on 28 March 2017, tearing roofs from several of the buildings and causing serious damage to others. An adjuster initially estimated insured damage at $3 million and uninsured damage, due to faulty or defective workmanship and/or defective materials, at $2.145 million. Delor Vue’s body corporate was aware at the time of defects in the complex’s eaves and soffits but was unaware of defects in the roof trusses. CJ Allsop said a question of non-disclosure arose once the loss began to be adjusted. “After the insurer had had an opportunity to ascertain the history of the defects, [and examined] the damaged property, it communicated a decision to the insured on 9 May 2017 that it confirmed cover and would pay the claim subject to the terms of the policy,” he said. A year later, after further adjustment of the claim, launching or threatening to launch subrogated proceedings against the builder, and renewing the policy, SCI wrote to Delor Vue with an offer to resolve the claim. The offer said it was open only for 21 days, after which SCI would deny responsibility for the claim based on non-disclosure and misrepresentation when taking out the policy, claiming a legal entitlement to reduce its liability to nil under s28(3) of the Insurance Contracts Act 1984 (Cth). SCI’s 28 May 2018 letter set out its position in detail, identifying aspects of the loss and damage covered and not covered. The letter said SCI would pay $918,709.90 for repairs but would not pay a further $3,579,432.72 because of “pre-existing defects/faulty workmanship and materials”. CJ Allsop said SCI/Allianz’s actions towards Delor Vue in 2018 exhibited “less than the utmost good faith”. “The position taken in May 2017 by SCI on behalf of Allianz was carefully considered (involving lawyers), quite likely perceived to be in Allianz’s interests, and honourable. “Ordinary people had suffered a serious loss to their properties. There was obviously an ‘issue’ about what the insured had known and what it had disclosed up to the point of the insurance incepting. The insured had co-operated fully in giving all its reports and knowledge of the problem to the adjuster and the claims handler from the first request after the loss,” CJ Allsop said. “A representation was made that cover was confirmed on policy terms. This was resiled from a little over a year later on a take-it-or-leave-it offer basis. That approach did Allianz no credit. “It put the insured in a critical position: take the offer or take nothing. That is not how an insurer should behave in these circumstances.” CJ Allsop said the parties should have used dispute resolution. Instead SCI/Allianz, having promised to pay the claim, gave an offer on a take-it-or-leave-it basis and in the alternative denied policy terms and invoked s28(3) of the Act, a course of action it had promised it would not do. He said that conduct was “not commercially decent and fair”. He accepted evidence SCI/Allianz would not have written the risk, had it been aware of the buildings’ defects at the time. Delor Vue had, for some years, recognised the defective construction of parts of the buildings and had obtained various reports since 2014, but its then body corporate agent had not progressed action on the problems. In 2016, about nine months before the SCI/Allianz policy was purchased and Tropical Cyclone Debbie wreaked havoc, a new agent, Stewart Key’s company Aspire, was appointed. CJ Allsop said Mr Key was an “efficient, precise, business-like and honest person, who, by March 2017, was attending with care and efficiency to the assessment and repair of the ... defectively affixed and constructed soffits and eaves. “Importantly, none of these problems had been identified as structural in the sense of relating structurally to the trusses or tie-downs of the steel roof structure of the buildings. (This problem was revealed upon examination of the damaged buildings, some with roofs blown off.) Especially with hindsight, it could perhaps be thought that, if the soffits and eaves were inadequately constructed and affixed in [several] places, there could be, as-yet-unseen, structural deficiencies in the roof structures. But this was not appreciated by Mr Key or the body corporate,” CJ Allsop said. They did, however, appreciate the danger to people or property if soffits fell to the ground. But he said a reasonable person, knowing what Mr Key and the body corporate knew, could not be expected to know the defective soffits and eaves were relevant to the underwriter’s decision on whether to accept the property damage risk and on what terms. CJ Allsop said some soffits had been fixed and there was a program to be implemented for the rest. “In the real world, a reasonable person in the insured’s position would be entitled to regard itself as in control of the low risk associated with the soffit panels.” That was reinforced by SCI being in “no hurry” to get any or all the soffit repair works conducted when it accepted the claim. “Notwithstanding these arguments, which have some force, a reasonable person in the position of the body corporate could be expected to foresee and be concerned by the risk, and to know that the insurer, which may have to pay compensation for death or catastrophic injury to someone hit by a falling soffit or eave, would want to know about the state of the buildings to assess the terms of the policy,” he said. The insurer might have wanted an increase in public liability premium or a specific bespoke exclusion for injury caused by the existing defects. CJ Allsop said the body corporate had failed to comply with the duty in s21(1)(b) for the public liability risk. However, the May 2017 email was relied on by the parties for a year as the basis of a relationship involving good faith and co-operation. The insurer was entitled to adjust the claim, enter the property whenever it needed to, and propose to sue a third party to further its subrogated rights. The insured did not have an opportunity to act for and by itself in that time to deal with the property damage and contest the insurer’s assertion of rights under s 28(3). CJ Allsop said the prejudice was “not specific, nevertheless it was real”. During that 12 months, Delor Vue could have “taken its own fate in its own hands and acted for itself in rectifying the property to the extent it was financially able to do so and in suing the insurer. “How that would have played out is impossible to tell ... because the parties conducted themselves on an entirely different basis. Allianz gained the benefit of assessing its own position by full access to the property and the full co-operation of Delor Vue.” CJ Allsop said it would be “unjust, inequitable and unconscionable” to permit SCI/Allianz to resile from its stated position in the email of 9 May 2017. “It should be held to the representation or promise (for that, as between honest commercial parties, especially bound by the duty of the utmost good faith, was what it was – a form of promise) that it made. It is a circumstance and outcome that is proportionate and reasonable.” Delor Vue Apartments CTS 39788 v Allianz Australia Insurance Ltd (No 2) [2020] FCA 588 For commentary on the case from McCabe Curwood, click here and from Jackson McDonald, click here. |

Resolve is the official publication of the Australian Insurance Law Association and

the New Zealand Insurance Law Association.