| HOME | NEXT |

Court rejects insurer’s appeal on damaged apartments

By Kate Tilley, Resolve Editor

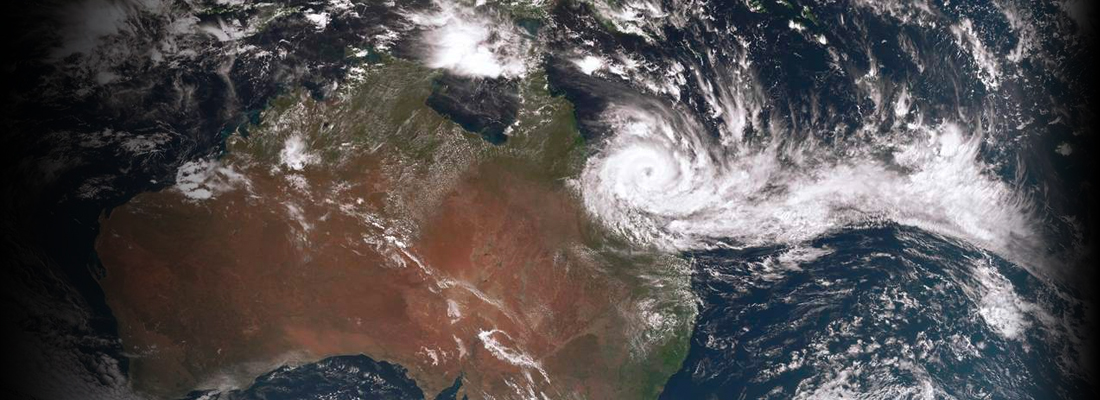

The Full Court of the Federal Court has rejected an insurer’s appeal against a decision it had exhibited “less than the utmost good faith” in a dispute with the body corporate of a Queensland apartment complex that was badly damaged by Cyclone Debbie in 2017.

The trial, before AILA patron and Federal Court Chief Justice James Allsop, was reported in the September 2020 issue of Resolve.

The appeal court decision saw Justices Neil McKerracher and Craig Colvin reject the appeal, while Justice Roger Derrington would have allowed it.

The Delor Vue complex at Cannonvale, near Airlie Beach, was built in 2008-2009 by developer Delorain Pty Ltd and builder Beachside Constructions (National) Pty Ltd. It has 11 multistorey residential apartment buildings with 62 lots.

The policy placed with Allianz-owned underwriting agency Strata Community Insurance (SCI) was incepted on 23 March 2017. Tropical Cyclone Debbie hit on 28 March 2017, tearing roofs from several buildings and causing serious damage to others.

Justices McKerracher and Colvin said initially Allianz (SCI) was arranging for the repair work (some of which Delor would pay for) and, as subrogated insurer, SCI would seek recovery from the builder and developer.

Unfettered access

For more than a year, the parties proceeded on the basis SCI had agreed to indemnify. SCI had “unfettered access to the property”, engaged engineers, arranged for a scope of works and obtained repair quotes. SCI also sought to quantify the extent of its liability, having confirmed indemnity in a May 2017 email.

During those steps, it emerged there were more defects with the roof construction, in particular, defects with the roof trusses and how they were tied down to the building.

That work was outside works detailed in the May 2017 email and not part of the insurance claim. Difficulties emerged about how the work would be scoped and the costs shared between SCI and Delor.

In May 2018, SCI wrote to Delor saying quantification by external loss adjusters of the cost of repairing cyclone damage as $918,709.90 and the cost of repairing pre-existing defects/faulty workmanship and materials as $3,579,432.72. SCI said it would pay the first amount, but not the second.

It gave Delor three weeks to accept the offer, otherwise the offer to indemnify would lapse and SCI would pay nothing, pursuant to s28 of the Insurance Contracts Act 1984, on the basis of Delor’s non-disclosure of the building’s defects.

Insurer estopped

Delor launched Federal Court proceedings in November 2018. After some preliminary steps, CJ Allsop made orders for two issues to be determined initially:

(1) whether Allianz was entitled to reduce its liability to nil under the Act, and

(2) whether by some operative rule or principle, Allianz was unable to rely upon s28.

CJ Allsop found in Allianz’s favour on the first issue but on the second, he found:

- Allianz was estopped from resiling from the representation in the May 2017 email that Delor’s claim would be honoured and indemnity provided, and the parties’ rights were to be determined by applying the terms of the policy and not by reference to an assertion of right under s 28(3),

(2) Allianz had waived any entitlement to assert a right under s 28(3), contrary to the Allianz’s position that the claim by Delor would be honoured and indemnity provided in accordance with the terms of the policy, and

(3) in seeking to resile from the representations made in the May 2017 email and in seeking to rely on Delor’s non-disclosure, Allianz failed to act towards Delor with the utmost good faith, contrary to s13 of the Act.

Allianz appealed against those three points.

Justices McKerracher and Colvin identified nine issues to be determined on appeal:

(1) As a matter of principle, when does the doctrine of election apply?

(2) On its proper construction, in what manner does s28(3) operate?

(3) Should CJ Allsop’s decision be upheld on the basis the common law doctrine of election applies?

(4) What was the nature of the estoppel case advanced by Delor before CJ Allsop?

(5) On what basis did CJ Allsop uphold the estoppel case?

(6) Did he err in doing so?

(7) Did CJ Allsop err in upholding the waiver case?

(8) Did he err in finding Allianz breached its duty of utmost good faith?

(9) Having regard to the conclusions on each issue, was the relief granted by CJ Allsop proper and appropriate?

Decision upheld

Justices McKerracher and Colvin upheld CJ Allsop’s decision, saying he was not in error in upholding Delor’s claims insofar as they were based on estoppel, waiver and utmost good faith.

“No error has been demonstrated in the declaratory relief granted by [CJ Allsop]. No real issue arises [about his] observations as to whether injunctive relief may be appropriate, given the finding that Allianz breached its duty of utmost good faith, because no such relief was ordered. Therefore, we express no view as to that aspect. It follows that the appeal should be dismissed with costs,” the pair said.

Justice Derrington’s dissenting judgement said his disagreement with CJ Allsop’s “customarily careful and erudite reasons … gives me great cause for pause and reflection”.

However, it was “difficult to identify the gravamen of Allianz’s conduct which was characterised as offending the duty of utmost good faith”.

Justice Derrington said Allianz’s alleged high-handed approach in its letter of 28 May 2018 was an offer to pay the amount it considered it would pay if it had adhered to its earlier intimation not to rely on Delor Vue’s non-disclosure.

While CJ Allsop considered the Delor Vue owners were “ordinary people” and the apartment complex’s damage significant, which was true, that did not affect the legitimacy of Allianz’s conduct.

“Where an insurer is called on to pay a claim for which it has no liability, the perceived financial standing of the insured (or the insurer) can have no relevance. It is difficult to envisage a case where the duty of utmost good faith will impose on an insurer an obligation to make a gratuitous payment depending on the apprehended wealth of the insured,” Justice Derrington said.

No breach

“Were it so, it would necessarily follow that the insurer’s current financial position would also affect the content of the duty. It would mean that, where an insurer is called on to act in a manner which is said to be in accordance with its duty and detrimental to it, it may be entitled to rely upon its extant financial position in deciding whether it will act or not.”

Justice Derrington found Allianz did not breach its duty of utmost good faith and had been willing to overlook the insured’s breach of the duty of disclosure and to gratuitously agree to partially indemnify the claim.

“It would be naïve to think Allianz’s conduct was solely altruistic. No doubt it believed that to partially honour the claim made good business sense, although that ought not to diminish the propriety of its conduct. Common sense dictates the conclusion that, when it offered to pay a portion of the claim, it did so in the belief the amount would be modest.”

Justice Derrington said neither party in May 2017 was aware of the magnitude of the remediation work actually required to restore the premises.

He said Allianz did not “contravene community standards of honesty, fairness or reasonableness and thereby breach its duty of good faith” when it gave Delor 21 days to accept the sum of $918,709, when its actual liability was nil.

That offer, on top of about $192,000 already paid, was “an appropriate display of commerciality rather than being parsimonious, unfair or unethical”.

Allianz Australia Insurance Ltd v Delor Vue Apartments CTS 39788 [2021] FCAFC 121

For case notes on the appeal from Turks Legal, click here.

Delor Vue Apartments CTS 39788 v Allianz Australia Insurance Ltd (No 2) [2020] FCA 588

For case notes on the trial from McCabe Curwood, click here and from Jackson McDonald, click here.

Resolve is the official publication of the Australian Insurance Law Association and

the New Zealand Insurance Law Association.