| PREVIOUS | HOME | NEXT |

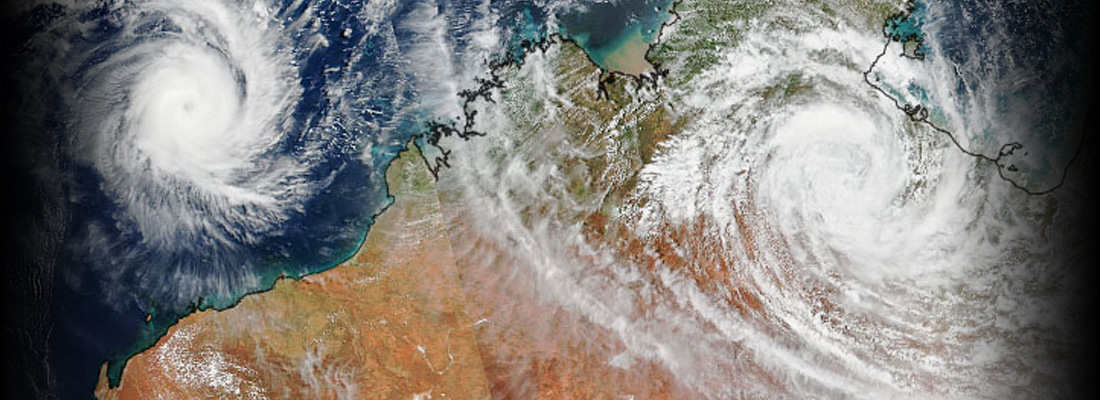

Deadline looms for cyclone pool

By Resolve Editor Kate Tilley

While only three insurers have so far joined the Australian Reinsurance Pool Corporation’s new cyclone pool, there are deadlines for when all insurers writing risks in cyclone-prone regions must sign up.

ARPC Chief Claims & Customer Officer Jason Flanagan and Head of Actuarial Pulkit Jain jointly presented at an AILA webinar where they outlined how the cyclone pool operates.

Mr Flanagan said ARPC was “in discussions” with other insurers. Large insurers have until 31 December 2023 to join and smaller insurers have another 12 months to the end of 2024.

The ARPC website defines smaller insurers as those with less than $300 million annual GWP for household insurance for the most recent financial year.

ARPC was initially established by the Federal Government in 2003 to administer a terrorism reinsurance pool. The cyclone pool was added in 2022, going live on 1 July and issuing its first rates on 1 October.

Pool’s goals

The cyclone pool aims to:

- Deliver a long-term cost neutral outcome to the government by covering expected annual average claim costs and the pool’s operating expenses.

- Provide reduced consumer premiums in medium and high-risk cyclone areas.

- Maintain premium levels comparable to current commercial reinsurance rates for nil and low-risk consumers.

- Reward risk mitigation, maintaining incentives for risk reduction and encouraging cyclone and flood-related mitigation over time.

- Publish an annual financial outlook report on pricing adequacy and scheme sustainability. (The first is due in 2024.)

The pool is backed by a $10 million government guarantee and charges insurers premiums based on property risk characteristics.

Mr Flanagan said the Australian Competition & Consumer Commission (ACCC) was tasked with monitoring premiums, although insurers could choose the premium levels they elected to charge consumers.

The ACCC website says the competition regulator monitors insurance products to evaluate the impact of the cyclone pool. It collects data to monitor insurance prices, costs and profits and provides at least one report each calendar year.

Mr Flanagan said the pool covers cyclonic wind, cyclone-related flooding and storm surge damage. There are 3.3 million eligible residential policies in northern Australia, 220,000 small business policies, and 140,000 residential and small commercial strata policies.

Mr Jain explained the premium setting formula, which effectively sees low-risk properties cross subsidise high-risk insureds.

Risk ratings

APRA determines the target premium pool, currently $776 million, spreads that across the geographic shape, factors in risk ratings and mitigation, then reallocates margin savings and tests the rate against insurer data.

Mr Jain said: “The pool doesn’t need to make a profit therefore the margin savings are reallocated. Low-risk properties cross subsidise high-risk properties to reduce premiums.”

ARPC actuaries use various catastrophe models for wind and add models for storm surge and fluvial (riverine) and pluvial flood.

Mr Jain said the models often disagreed on high and low-risk areas, particularly for flood. ARPC commissioned catastrophe modelling company Risk Frontiers to conduct two studies to estimate the proportion of flood caused by cyclone within 48 hours of downgrade – the time frame within which the pool provides coverage:

- a literature review of historical cyclone events, and a

- basin discharge study that analysed historical rainfall and elevated river levels.

He said 55% of flooding in north Queensland was cyclone related but only 10% in NSW.

The cyclone pool rating formula considered the three main perils:

- wind, water ingress and flash flooding

- riverine flooding, and

- storm surge.

BoM declaration

Risk mitigation, for example, fitting roller doors, window protection, elevated floor levels and roof replacements were factored in.

Mr Flanagan said the pool was on risk when the Bureau of Meteorology declared a cyclone event. Claims were managed by insurers and the onus was on them to determine claim eligibility. ARPC settled claims quarterly and conducted validation and audit processes.

In the Q&A session, Mr Flanagan said insurers could decide whether they wanted to write risks in high-risk areas but pool participation was mandatory if they elected to do so. However, participation for Lloyd’s syndicates is voluntary.

ARPC’s website says the legislation allows an exception to mandatory cyclone pool participation if an insurer’s cyclone pool eligible premium income is less than $10 million in the most recent financial year.

Greater competition

Mr Flanagan said cyclone risk was “the main reason some insurers don’t offer coverage in north Queensland” and the government hoped the pool’s establishment would encourage greater competition in the region.

Mr Jain said ARPC premium discounts of 30%-40% were available for retrofitted buildings and areas with flood levees were discounted.

Once more insurers joined the scheme, ARPC data collection would “provide insights for other government agencies” conducting mitigation projects.

Asked whether ARPC was likely to add other perils to cyclone and terrorism events, Mr Flanagan said that was a matter for Treasury and government policy.

In the same week Mr Flanagan and Mr Jain presented to AILA, a Joint Parliamentary Committee for Northern Australia released a report on the cyclone pool.

ARPC modelling

The report said evidence to the inquiry indicated the two main concerns with implementation of the cyclone pool were:

- the timing of the release of ARPC modelling, and

- whether the anticipated savings generated by the pool for policyholders would materialise.

Several other topics raised by stakeholders to the committee related to the pool’s ongoing operation and implementation, including:

- further incentives to encourage insurers to provide coverage in northern Australia and join the pool

- the budget neutrality requirement

- the length of the 48-hour coverage period after a cyclone is downgraded

- the inclusion of marine insurance

- the impact of climate change on the pool’s operation

- differences in insurance coverage across states and territories, and

- concerns about the ACCC’s role.

Resolve is the official publication of the Australian Insurance Law Association and

the New Zealand Insurance Law Association.